Blog

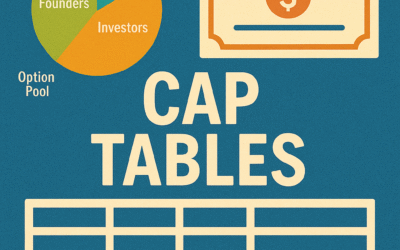

Cap Tables 101: What Every Founder Should Know Before Fundraising

Cap Tables - The Ownership Map of Your StartupA cap table, or capitalization table, is a simple spreadsheet that shows who owns how much of a company. Think of it as the scoreboard for shares. When you raise startup funding, investors look at this table first. A...

How to Build a Pitch Deck That Investors Can’t Ignore

Before an investor agrees to a meeting, they flip through your pitch deck. If the deck is clear, short, and bright, the door opens. If it is messy, the door stays shut. In this guide we show how to craft a deck that grabs attention. Pitch Deck key principle: Keep It...

Funding Innovation in Emerging Markets, Lessons from the MENA Region

Many life‑changing ideas grow in emerging markets. Clean water pumps in Kenya, mobile wallets in Egypt, and tele‑health in Jordan started with small budgets but bold goals. Yet founders in these regions still ask one question: “How do we fund our growth?” In this...

Challenges Facing MENA Startups in 2025 and How to Beat Them

Startups in the Middle East and North Africa run faster each year, yet 2025 brings fresh hurdles. Capital gaps, uneven rules, and talent shortages top the list. Do these hurdles stop founders? No. Smart teams turn bumps into stepping‑stones. This guide names the big...

Inside Egypt’s Startup Scene—Trends, Sectors, and Opportunities

A Fast‑Moving PlaygroundWalk down a street in Cairo and you will see riders in bright jackets, QR codes on shop doors, and teens paying with mobile wallets. These sights show how Egypt’s startup scene is growing. In 2024 the country grabbed almost 30 % of all startup...

Why the Middle East Is the Next Hotbed for Tech Startups

Think of a campfire that just caught a steady flame. The Middle East is that new fire for tech startups. A young population, fast internet, and fresh rules make the region glow. Big funds and smart founders now see the same spark. This article shows why the Middle...

The Biggest Mistakes Founders Make When Pitching to Investors

A Pitch Can Open or Close a DoorYou get only 10–15 minutes with an investor. In that short time, you can unlock startup funding or walk away empty‑handed. At Kadri VC we watch many pitches each week. We see common errors that hurt good ideas. This guide lists the...

What We Look for Before Investing – The Kadri VC Criteria

Four Pillars Hold Up a Winning StartupAt Kadri VC we meet hundreds of founders every year, from Cairo makers to Alexandria coders. We cannot fund everyone. To decide fast and fair, we use a simple checklist of four pillars: Team, Market, Product, and Economics. If...

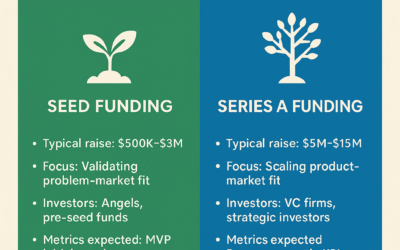

Seed vs. Series A: Understanding the Startup Investment Journey

A baby does not run before it walks. A startup company also moves in small steps before leaping. In the world of startup funding, the first two big steps are the Seed round and the Series A round. Each round has a job to do, and each uses money in a different...

How to Secure Your First Venture Capital Check? What Founders Need to Know

It is really a big step, but not a magic trickGetting the first check from a venture capital fund feels huge. It shows that someone with money trusts your idea and your team. But it is not luck. You can plan for it. In this guide you will find clear, direct steps so...